Sampah Plastik

Blockchain Startups in Plastic Waste Management

Plastic has been a problem for 400 years, that's 16 generations. 91% is not recycled, which ultimately impacts us and the environment. Plastic waste is everywhere, we eat plastic, drink plastic, breathe plastic. More than 2 trillion plastic bottles are sold every minute, half of them from Asia, and Indonesia ranks second among the biggest polluters in China.

Today the term circular economy appears again and again. In the old linear economy, the product cycle went from the manufacturing or manufacturing phase to the use phase, and in the end the product was disposed of as a waste material. But this old linear economy is destroying the earth, not everything we produce is biodegradable. In a circular economy, product life is like a cycle. From the manufacturing process to the use phase to disposal, we can recycle and reuse as much as possible. Policymakers around the world are striving for a more circular economy by reducing the amount of new resources needed to keep the economy going and by minimizing the amount of waste.

Plastic Finance is the first blockchain-based plastic bank in Indonesia. Lift scavengers out of poverty Give the poor access to bank loans through defi. Financing plastics will increase access to jobs, education, services and technology for many Indonesians. Also, help the government achieve green planning or ecological budgeting through land protection. Clean the environment and benefit from it at the same time.

RECYCLE REUSE and PROSPER

What is plastic finance?

Plastic Finance provides an environment, social environment and governance also known as ESG themed investments using cryptocurrency and blockchain technology. 1 PLAS token with a selling price of 10 kg of carbon dioxide per year and approximately 6.4 tons of recycled plastic per year. By recycling, Plastic Finance contributes to CO2 emissions as a number of profits are used for Greenify initiatives such as planting teak trees in decarbonized areas.

Financing Plastics empowers plastic waste pickers through cooperatives and DeFi by providing them with financial inclusion and access to education. For every 50 tonnes of recycling per hour, 50 people are needed in the supply chain. Plastic Finance targets to recycle 80,000 to 2,16,000 tons of plastic waste per year by the end of 2023.

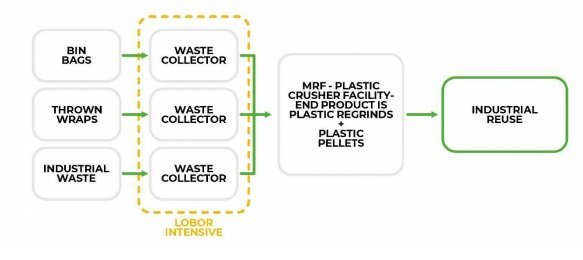

Blockchain technology and stable coins can play a big role in incentivizing households and MRFs to streamline funding for the plastic recycling industry. With smart contracts, we can tokenize all kinds of plastic regrinds and pellets, create internal exchangers so people and industry have easy access to monetize plastic waste, and blockchain provides more transparency for any plastics industry supply chain. In addition, we can create DeFi-Dapps (decentralized financing, decentralized applications) so that waste can be pledged as assets.

Plastic Finance's Vision

With Blockchain and DApps, Plastic Finance can streamline the recycling business flow and empower scavengers to get better care for their hard work. Plastic Finance will create an app that scavengers can use to sell their waste to MRF, exchange it for cash, or store it as an asset in the form of Grinds Stable Coin, which can be pledged on our DeFi platform.

How the Platform Works

Plastic Finance works in two ways: empowering the waste community (such as scavengers, scavengers, etc.) and rewarding those involved in the network. Scavengers will be rewarded for their contributions, where they have the option to earn money in tokens or fiat (real) money. If they prefer crypto tokens, they can actually take part in the platform. They can use this platform to gain access to finance, and this is rare because the trash community is usually the unbanked. Well, with this platform, these unbanked people can finally enjoy financial access

What are PLAS tokens?

PLAS is the native token of the Plastic Finance ecosystem. PLAS was created to fund recycling projects and serves as a governance and token of ownership to receive student dividends or share profits from recycling and DeFi transactions and internal stock market deployments.

Plastic Finance charges 5% of the internal exchanger spread price for plastic regrind and 0.175% fee for deposit withdrawal transactions or loan payments on the DeFi platform. All these fees are bundled in the wallet and can be distributed regularly with the help of smart contracts.

Plastic Finance annually collects 60% of the net profit from the cooperative's recycling business. In return, Plastic Finance will distribute costs and profit sharing to PLAS holders as dividends.

Token PLAS

PLAS is the native token of the Plastic Finance ecosystem. PLAS was created to fund the Recycling project and serves as a governance and ownership token for earning student dividends or profit sharing from recycling and DeFi transactions, Internal Exchange spreads.

Plastic Finance will collect a 5% fee from the price of the plastic internal exchanger spread, and a 0.175% fee from a savings withdrawal transaction or loan payment on the DeFi platform. All these fees will be collected in the wallet and using a smart contract, can be distributed regularly.

Plastic Finance collects 60% of its net profit annually from the cooperative's recycling business. In turn, Plastic Finance will distribute costs and profit sharing as dividends to PLAS holders.

Tokenomics

- Ticker: PLAS

- Token Type : BEP-20 MainNet

- Token Address : 0xCe34caAEe0b691F8e4098DC31CC8818A1dCcF06A

- Token Sale Address : 0x1800C25a3Ed60B41766B8EE94f40CE05A84407aB

- Total Token Supply : 23,900,000 PLAS

Token Sale

- TOTAL SUPPLY: 23.900.000 PLAS

PUBLIC SALES TOTAL:2.000.000 PLAS @ USD1

KONTRIBUTOR AWAL: 7.300.000 - PLAS locked for up to 27 months

ACCREDITED INVESTOR SALES : 2,000,000 PLAS @ USD 0.375 minimum USD 20,000 - Pre-Sale: 2,000,000 PLAS@ USD 0.6

- AIRDROP or Community Grant: 1000.000 PLAS

- Hardcap Pre Sales + Accredited Sales = $1,950,000

- Total Hardcap Public Sales = $2,000,000,- (can be planned to be IFO if pre-sale and private sale are successful)

- Total Hardcap: $3,950,000 PLAS

price calculation pegged to USD value

pledged as assets

REJECTION

As always, Please DO YOUR OWN RESEARCH BEFORE Investing your hard-earned BNB into These Projects And Never Invest More Than You Want to Lose.

For more information about PLASTIC FINANCE, click the link below

OFFICIAL LINKS WEBSITE : https://plastic.finance/

LINKEDIN: https://linkedin.com/company/plastic-finance

TWITTER: https://twitter.com/plastic_finance

FACEBOOK: https://www.facebook.com/Plastic-Finance-110471187905120

TELEGRAM GROUP: https://t.me/plasticfinance

TIKTOK: https://www.tiktok.com/@plastic.finance?

YOUTUBE: https://www.youtube.com/channel/UCxZvaGVdcOJ-_SnGaEn4kew

MEDIUM: https://medium.com/@Plastic_Finance

INSTAGRAM: https://www.instagram.com/official_plasticfinance/

Username moricuy Link: https://bitcointalk.org/index.php?action=profile;u=2633291

Komentar

Posting Komentar